Financial Planner Diploma

- Online

- 54 WeeksEvening

Financial Planner

Diploma Summary

The Financial Planner online diploma course will introduce students to the financial planning process. Students will be able to prepare professional financial plans and manage various financial matters. They will learn about cash flow and budgeting, which will help them create personal wealth. The course will address the fundamental factors to consider when creating a strong plan to meet long-term financial objectives in a business.

The course is structured for personal application and aims to establish credibility in the financial services industry. Students will learn financial tools and techniques to build and maintain beneficial relationships with their customers.

Financial Planner

Course Highlights

Preparation for the Canadian Securities Course examination.

- Students will learn the techniques and tools for building and maintaining financial and beneficial relationships with their clients.

Students will be prepared and trained to work in the financial sector.

Students will be equipped with technical knowledge of financial planning and analytical skills. This will help them learn the Financial Planning Practices of the CFP profession.

- Learning during the program will help students investigate the ethical and evaluative challenges that arise in the corporate world.

Career Opportunities

- Financial Planner

- Financial Planning Representative

- Associate Financial Planner

- Investment/Retirement/Tax Planner

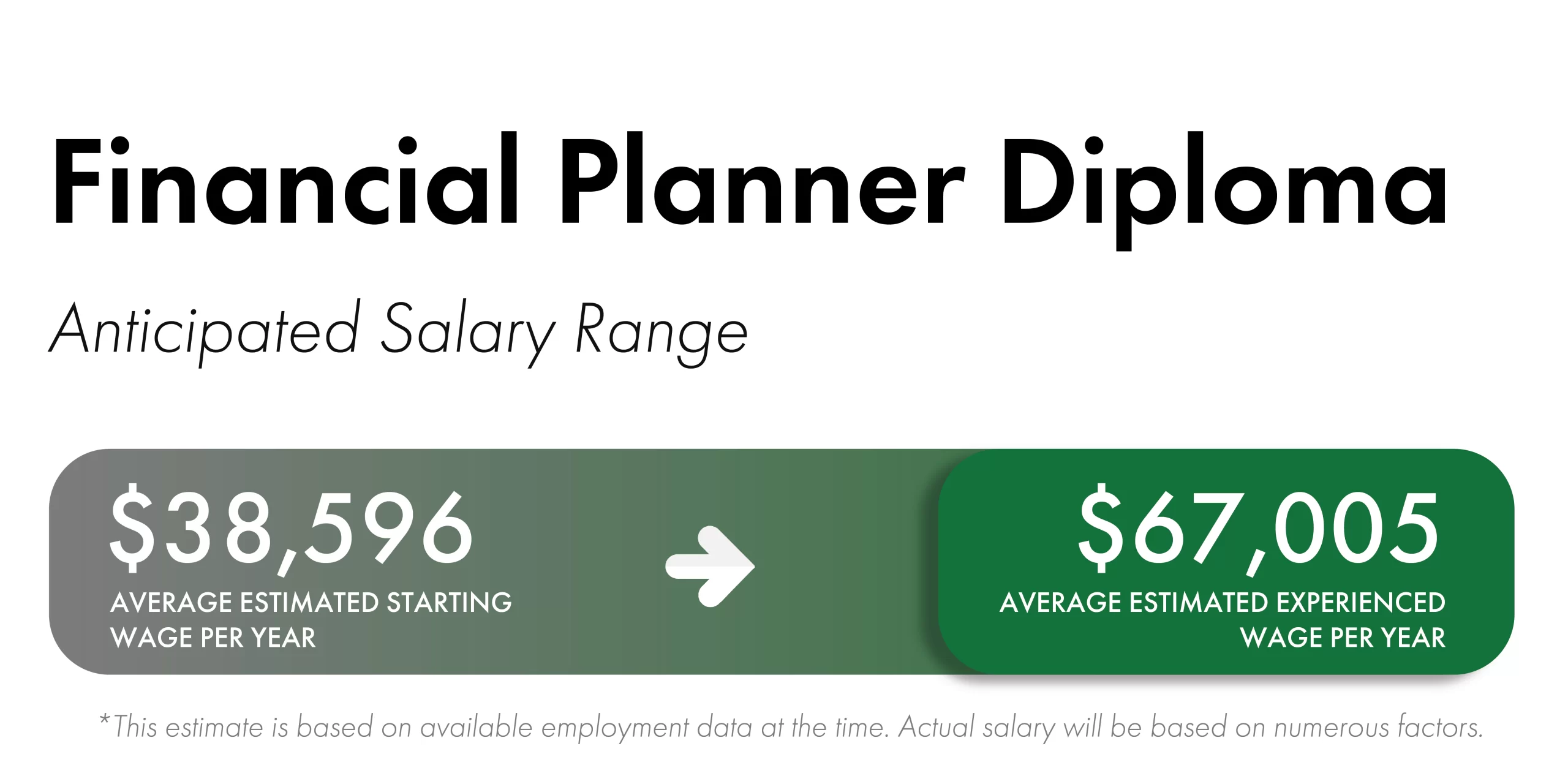

Salary Range

Financial Planner Diploma Information Kit

This kit includes important details on the Financial Planner Diploma program at ABM College.

Financial Planner Information Kit

"*" indicates required fields

Course Curriculum

Admissions Requirements

Student Recommendations of ABM College